Overview

While most major marketplaces automatically collect and remit taxes on your behalf, there are certain integrations where you may be responsible for calculating and applying taxes instead. Sellercloud’s Tax Rates Per Channel tool gives you full control over how taxes are calculated for orders placed through these sales channels.

This feature is especially useful for businesses operating across multiple regions, as it allows you to set tax rates by country and state. You can also choose whether taxes should be applied based on the shipment origin or the order destination, ensuring compliance with varying regional tax regulations.

Currently, custom Tax Rates can be configured for:

Manage Tax Rates Per Channel

An order tax refers to the additional tariff applied to a customer’s purchase at the time an order is placed. In Sellercloud, Tax Rates can be tailored per channel to apply Sales and/or State taxes and can be based on factors like:

- The location of the buyer (Destination Based Tax).

- The origin of the shipment (Origin Based Tax).

Create Tax Rates Per Channel

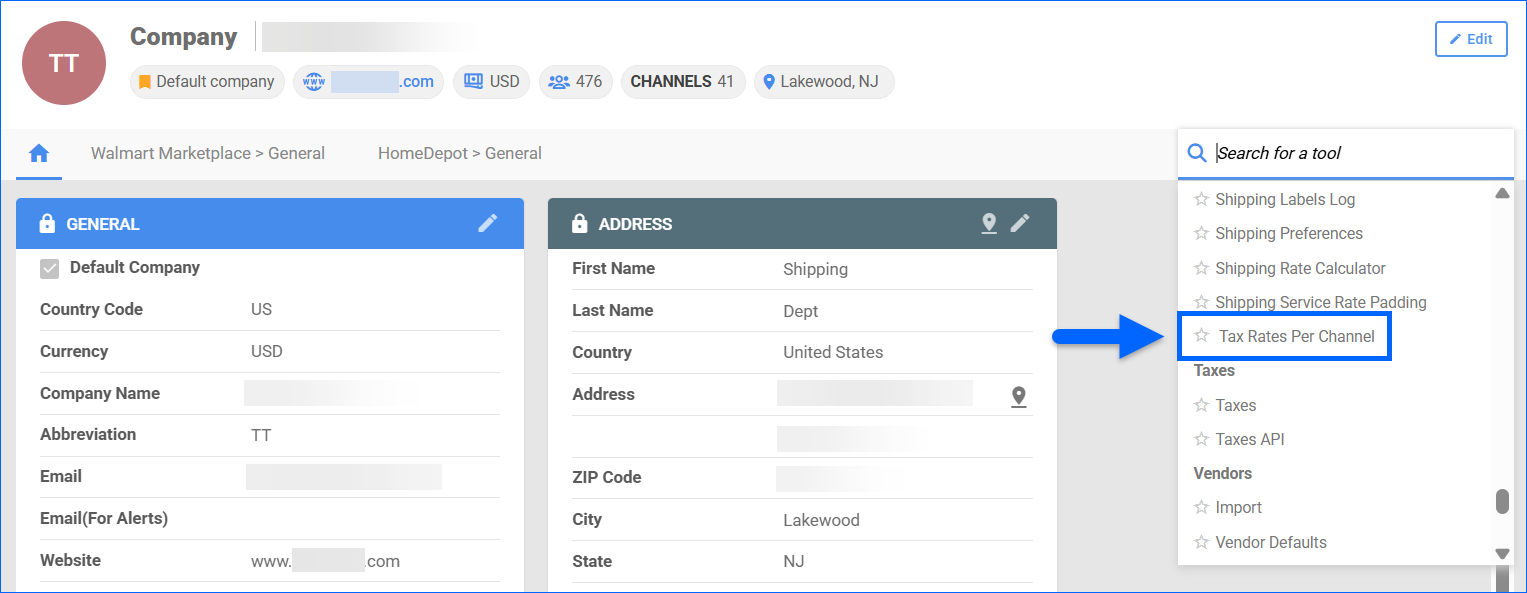

To create a new Tax Rate Per Channel:

- Navigate to Settings > Company > Select a company.

- Go to Toolbox > Tax Rate Per Channel.

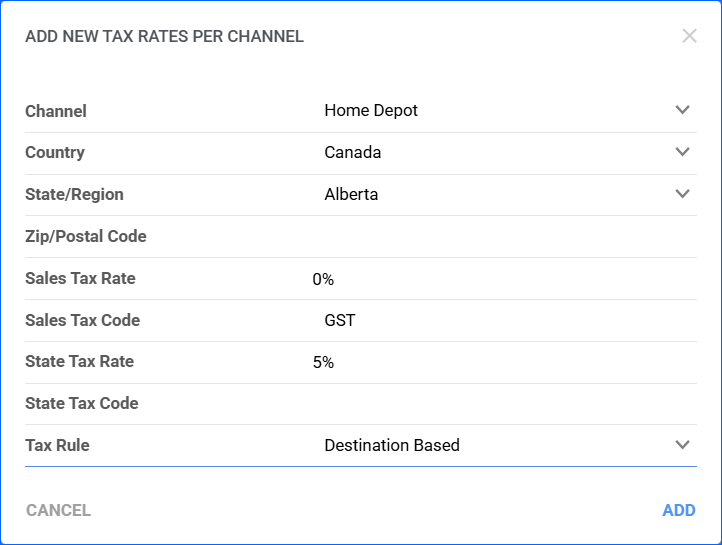

- Click the + icon to add a new Tax Rate entry.

- Populate the following details:

- Channel – Select a channel from the dropdown menu:

- Wayfair

- Home Depot Canada

- Direct Fulfillment

- Vendor Central

- Country – Specify the country for which the tax applies.

- State/Region – Select the country’s state or region, if applicable.

- Zip/Postal Code – Enter a Zip/Postal Code.

- Sales Tax Rate – Enter what percentage of the sales amount should be added as a Sales Tax.

- Sales Tax Code – Indicate the Sales Tax abbreviation.

- State Tax Rate – Enter what percentage of the sales amount should be added as a State Tax.

- State Tax Code – Indicate the State Tax abbreviation.

- Tax Rule – Select how the tax will be applied:

- Destination Based

- Origin Based

- Channel – Select a channel from the dropdown menu:

- Once done, click Add.

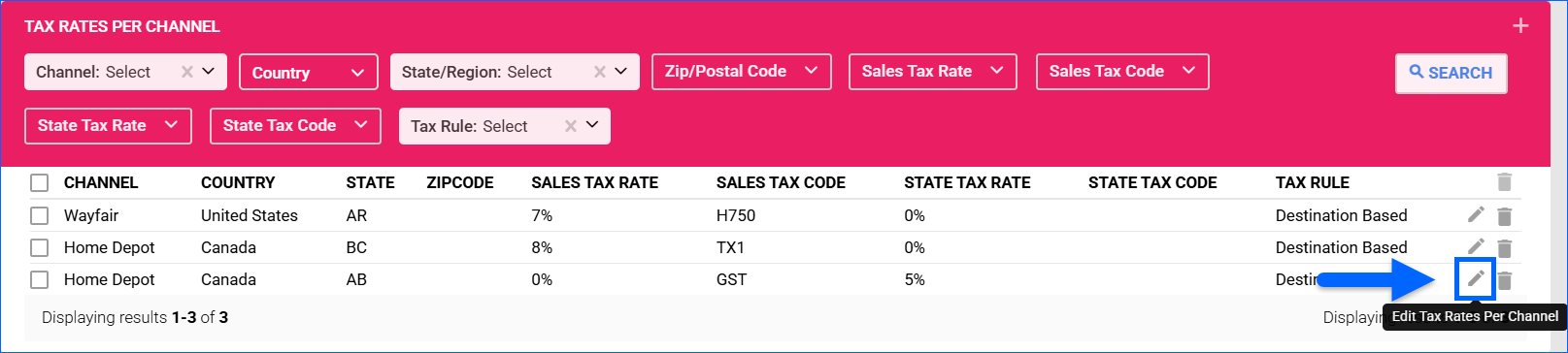

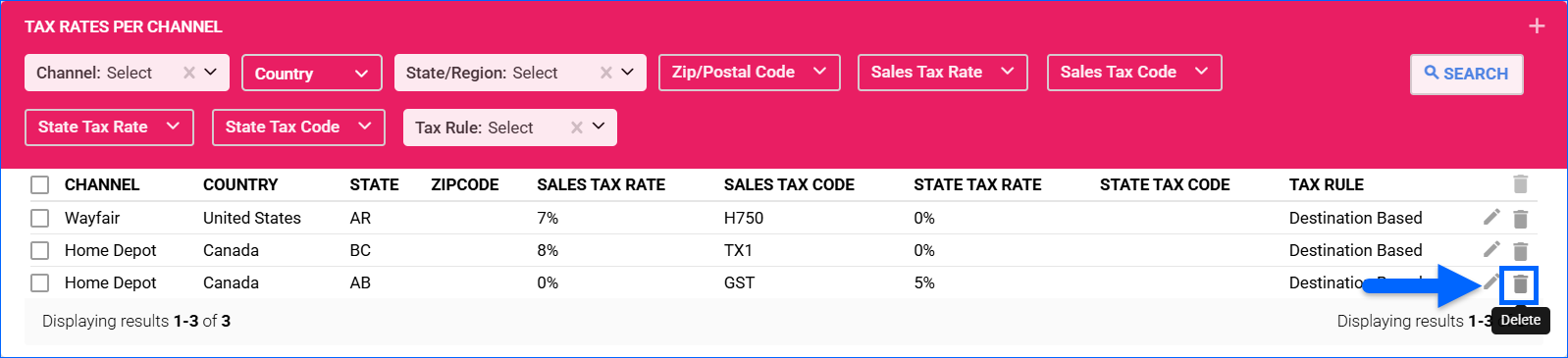

Search Tax Rates Per Channel

Existing Tax Rates can be found by using the following filters:

- Channel

- Country

- State/Region

- ZIP/Postal Code

- Sales Tax Rate

- Sales Tax Code

- State Tax Rate

- State Tax Code

- Tax Rule

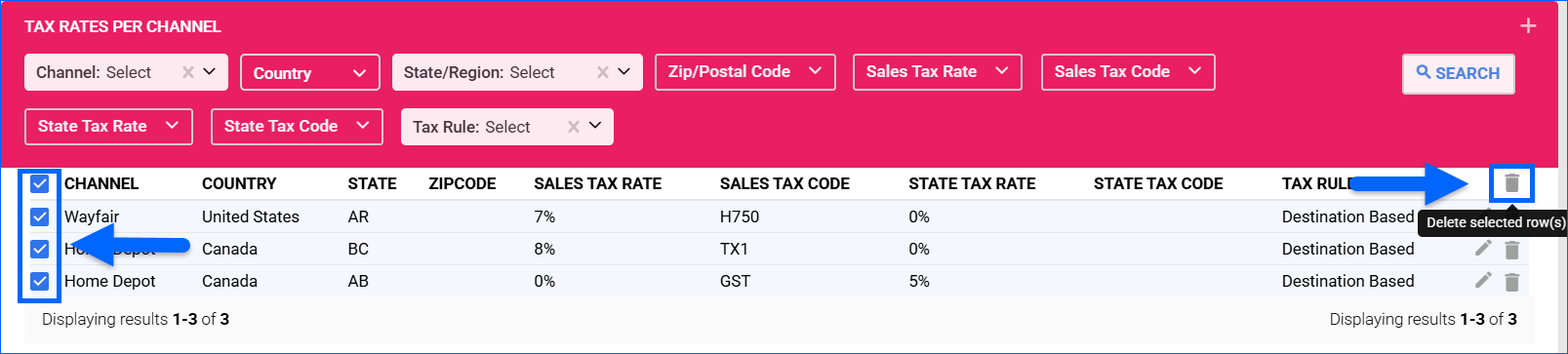

To update Tax Rate details, simply click the respective Edit icon.

Delete Tax Rates Per Channel

You can permanently delete a Tax Rate Per Channel entry by clicking on its Trash icon.

To erase multiple Tax Rates, select their respective rows in the grid and click the main Trash icon.