Overview

Sellercloud automatically applies taxes for all US orders. You can configure tax rates that automatically apply to non-US, local store, and wholesale orders separately.

Order Types

Your Client Settings offer options to control what order types you apply tax rates to. These settings affect all Local Store, Wholesale, and Website orders:

- Stop Calculating Taxes for LocalStore order

- Stop Calculating Taxes for WholeSale orders

- Stop Calculating Taxes for Website orders

- Note: Enabling this setting can often lead to a double tax charge on orders because tax is typically configured on the website.

Manage Tax Rates

Local Store and Wholesale orders that match the related Country and State will have their taxes set to your specified rate.

You can manage tax rates individually or in bulk.

Individually

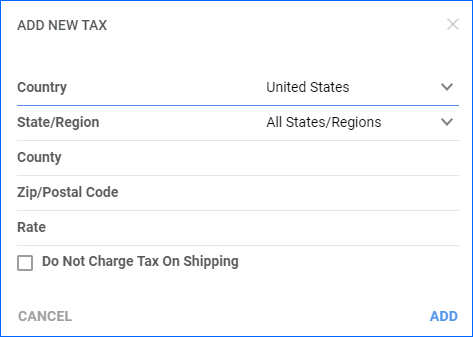

To add custom tax rates one by one:

- Go to Company Settings.

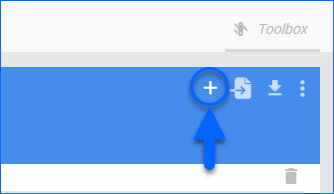

- Click Toolbox and select Taxes.

- Click Add New Tax.

- Add the Country, State, County, Zip/Postal Code, and Tax Rate.

- Optionally, you can check the Do not charge tax on shipping box.

- Click Add.

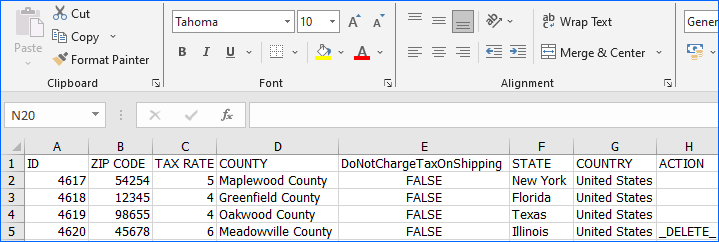

In Bulk

To bulk import tax rates:

- Go to Company Settings.

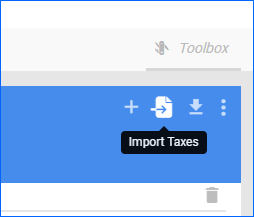

- Click Toolbox and select Taxes.

- Click the Download Sample icon.

- Update the template file. You can populate these two columns:

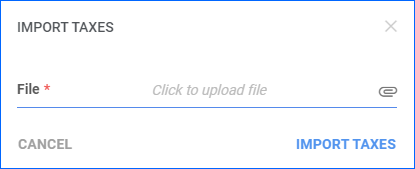

- Click the Import Taxes icon.

- Click File and select the updated file.

- Click Import Taxes.

Tax Details

Review the following important details about tax handling:

- Sellercloud rounds tax rates to the third decimal place. For example, 0.0775 would round to 0.078.

- There is a tax on all products by default. However, you can set products to be tax-exempt by checking the Tax Exempt on the product home page checkbox. You can bulk update this using the column header TaxExempt.

- You can clear the tax on an order by clicking Edit Order and then Clear Tax.

- POSBridge orders will be taxed based on the rate set in POSBridge.

- See the TaxJar article for information on automatically updating tax on orders and submitting tax filings.