Overview

Order tax is the sales tax that’s applied to a buyer’s purchase, typically based on the shipping destination, the products being sold, and the customer’s tax status. Accurate tax calculation is essential for compliance with local tax laws, as well as precise invoicing, accounting, and profit reporting.

This article explains how to:

- Configure order tax settings for different channels.

- Define and manage tax rates at the company, customer, and product levels.

- Update, import, or export tax amounts manually or through plugins and mapping tools.

- Handle tax exemptions for specific customers or products.

- Review tax data in reports.

- Integrate third-party tax solutions.

Sellercloud supports automated and manual tax workflows across multiple sales channels. You can apply tax at the time of order creation, import it from external sources, or rely on post-shipment settlements, depending on your business needs and integration setup.

Key Details

Sellercloud offers flexible and accurate tax handling for both U.S. and international orders. It automatically calculates tax for all U.S. orders and allows you to Manage Tax Rates for specific channels, regardless of country.

Most major marketplaces automatically collect and remit taxes, and order tax amounts are not applied at the time of order creation but are imported post-shipment via Settlement Reports. For example, Amazon and Walmart provide settlements approximately every two weeks. These reports contain the final tax data, which Sellercloud uses to update the order’s Profit & Loss (P&L). This ensures your financial records reflect the actual tax collected by the channel.

For channels that do not support settlements (e.g., Local Store or Website), you must Configure Tax Rates manually in Sellercloud or use a third-party tax integration.

Note the following details regarding tax handling:

General Considerations

- Sellercloud rounds tax rates to the third decimal place. For example, 0.0775 rounds to 0.078.

- Tax is not included in your profit, even though it’s part of the amount paid by the customer. It may still appear on the invoice and total calculations for reconciliation.

- For international orders via FedEx or UPS, you can configure who pays Duties and Taxes: the Sender, the Receiver, or a Third Party (FedEx only).

- Sellers that operate in European markets should provide their EU customers with Value Added Tax (VAT) Invoices. This replaces the standard US tax logic with VAT-specific fields.

- Learn how Marketplace Facilitator Tax works for marketplaces like Amazon, Walmart, eBay, and Etsy. Note that Sellercloud still includes Marketplace Facilitator Tax in the order cost because it’s part of the total payment made by the customer. This ensures accurate profit reporting using the formula (Payment + Adjustments) – Order Cost = Net Profit. Excluding tax from the cost would overstate profit, so it’s always included to reflect the true cash flow.

Show Tax in Emails and Invoices

- You can show the order tax amount in your Word2PDF Invoices using the placeholder #?TaxTotal?#.

- These placeholders for Email Templates are available: #?TaxTotal?# shows the total tax amount, and #?TaxExempt?# will populate True if there’s a tax-exempt customer.

Marketplace Integrations

- For Amazon listings, taxability is driven by Amazon Tax Codes. As a Marketplace Facilitator, Amazon collects and remits taxes on behalf of the seller. However, the taxes are included in the Payment amount and still appear in Sellercloud. They are marked as Paid by Channel, as explained in the Marketplace Facilitator Tax article. Learn more about how Amazon Calculates Tax.

- eBay typically collects and remits order taxes as a Marketplace Facilitator. However, you can enable the Client Setting Stop Removing Taxes From eBay Orders to retain any tax amounts included in eBay orders instead of removing them.

- POSBridge orders are taxed based on the rate set in POSBridge.

Accounting Integrations

- Avalara offers real-time tax rate calculation and exemption handling based on the latest tax laws across thousands of jurisdictions. With the Avalara Integration, you can automatically calculate accurate sales tax at checkout, apply tax exemptions, and sync order-level tax data. Refunds and transaction history can also be submitted to Avalara for audit compliance and remittance.

- TaxJar provides automated sales tax reporting and filing across U.S. states. With the TaxJar Integration, Sellercloud can retrieve real-time tax calculations, manage tax-exempt customers, submit orders and refunds to TaxJar,

- QuickBridge is Sellercloud’s proprietary integration tool for syncing order, payment, and tax data with QuickBooks. In terms of order tax, QuickBridge maps sales tax from Sellercloud orders to Sales Tax or Other Charge items in QuickBooks.

- ConnectBooks is a financial reporting tool. The ConnectBooks Integration with Sellercloud provides accurate, real-time profit and loss analytics. While it does not calculate tax directly, it plays a key role in mapping and visualizing collected sales tax by order, marketplace, or state, offering clarity on tax liability and supporting reconciliation with accounting platforms.

Control Tax Calculation

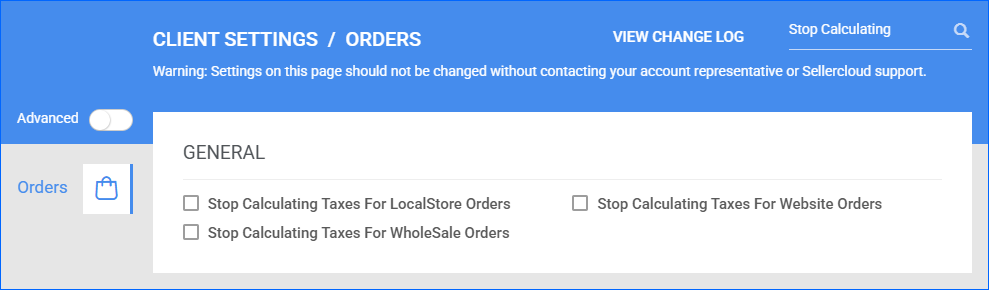

Your Client Settings determine the other order channels for which Sellercloud will calculate and apply tax:

- Stop Calculating Taxes For LocalStore Orders – Prevent Sellercloud from automatically applying tax to Local Store orders.

- Stop Calculating Taxes For WholeSale Orders – Prevent Sellercloud from automatically applying tax to Wholesale orders.

- Stop Calculating Taxes For Website Orders – Prevent Sellercloud from automatically applying tax to Website orders.

Disabling the Stop Calculating Taxes for Website Orders setting may cause duplicate tax charges on Website orders because taxes may already be calculated on your website.

Manage Order Tax Rates

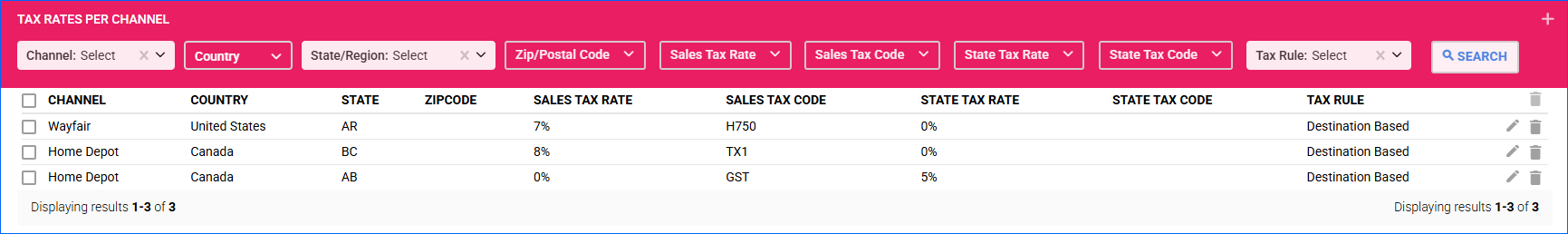

While most major marketplaces automatically collect and remit taxes, you can apply custom configurations for orders from these channels based on the order’s Country and State:

- Direct Fulfillment

- Vendor Central

- Home Depot Canada

- Wayfair

- Local Store

- Wholesale

Per Channel

The Tax Rates Per Channel feature lets you control tax rates for orders from Direct Fulfillment, Vendor Central, Home Depot Canada, and Wayfair. You can choose whether taxes apply based on the shipment origin or the order destination, ensuring compliance with varying regional tax regulations. See Tax Rates Per Channel for step-by-step instructions and additional details.

For Wholesale and Local Store Orders

Sellercloud allows you to define custom tax rates for Local Store and Wholesale orders individually or in bulk.

The tax settings also control whether you charge tax on shipping or not. The Do not charge tax on shipping option prevents sales tax from being applied to shipping charges on an order. This is useful in jurisdictions where shipping isn’t taxable for compliance with local tax laws. For example, in California, shipping charges are not taxable if they are separately stated on the invoice and the actual cost is passed to the customer. So, if you sell a product for $100 with $10 shipping, only the $100 is taxed. In contrast, in New York, shipping charges are taxable if the order item is taxable. In that case, both the $100 item and the $10 shipping are subject to sales tax.

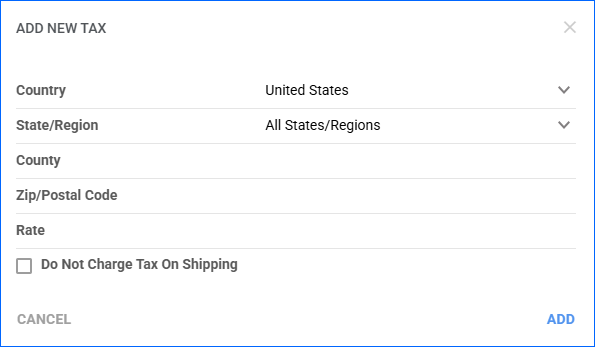

To add custom tax rates individually:

- Go to Company Settings.

- Click Toolbox and select Taxes.

- Click Add New Tax.

- Add the Country, State, County, Zip/Postal Code, and Tax Rate.

- Optionally, check Do not charge tax on shipping.

- Click Add.

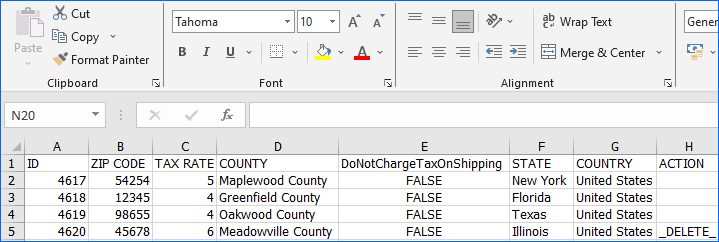

To bulk-import, update, or delete tax rates:

- Go to Company Settings.

- Click Toolbox and select Taxes.

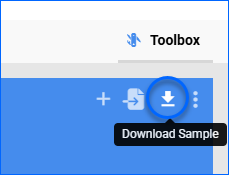

- Click the Download Sample icon.

- Update the template file. You can also use these two columns:

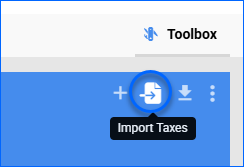

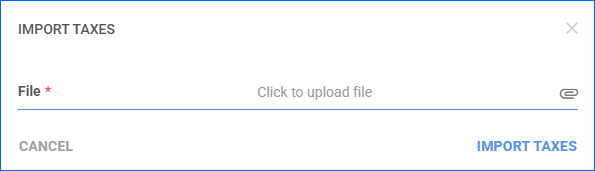

- Click the Import Taxes icon.

- Click File and select the updated file.

- Click Import Taxes.

Manage Tax Exemption

When you mark a customer or product as tax-exempt in Sellercloud, the system excludes applicable sales tax during order calculation involving that customer or product.

Customer Tax Settings

By default, all customers are taxable. To make a customer tax-exempt:

- Go to Customers > Manage Customers.

- Click the customer’s ID.

- Click Edit.

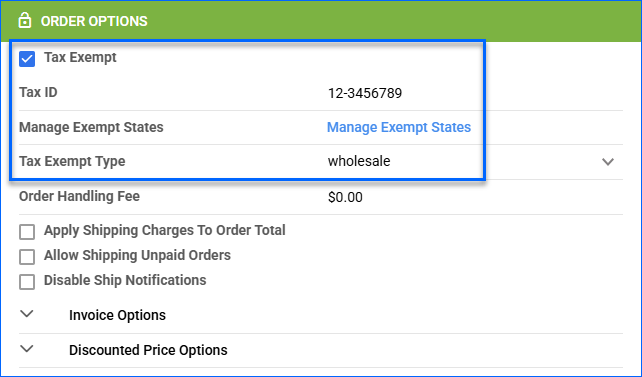

- Check Tax Exempt.

- Enter the customer’s Tax ID.

- Configure the Tax Exempt Type:

- Government – For customers that represent government agencies or departments, which are generally exempt from sales tax under federal or state laws.

- Wholesale – For customers purchasing goods for resale rather than personal use. These customers typically provide a resale certificate to qualify for tax exemption.

- Other – A general-purpose exemption category for situations that don’t fall under government or wholesale, such as religious organizations or educational institutions with valid exemption status.

- Non-Exempt – Explicitly marks the customer as not tax-exempt.

- Click Manage Exempt States and then check Charge tax on orders based on tax-exempt states to apply the customer’s tax exemption only in the states you select. In all unchecked states, the customer will be charged tax, even if they are marked as tax-exempt.

- Click Save.

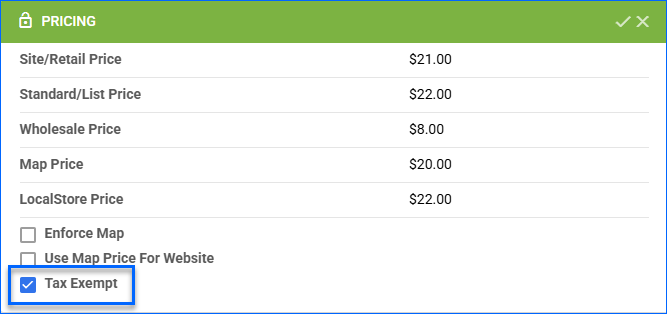

Product Tax Settings

By default, all products are taxable. To make multiple products tax-exempt, set the TaxExempt column to True in a Bulk Update.

To make a single product tax-exempt:

- Go to the Product Details Page.

- Click Edit.

- In the Pricing panel, check the Tax Exempt box.

- Click Save.

You can also set a product as tax-exempt only on a Specific Order.

Update Order Tax

You can update tax amounts manually per order, in bulk with a plugin, or automatically with the Import Mapping Tool.

Manually

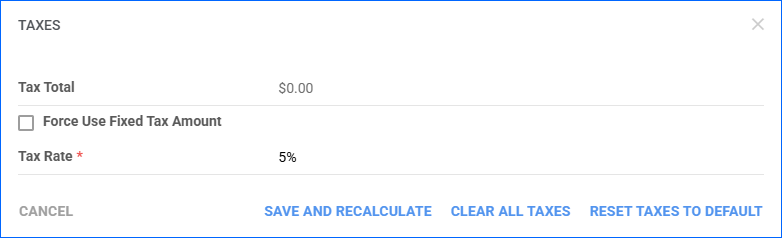

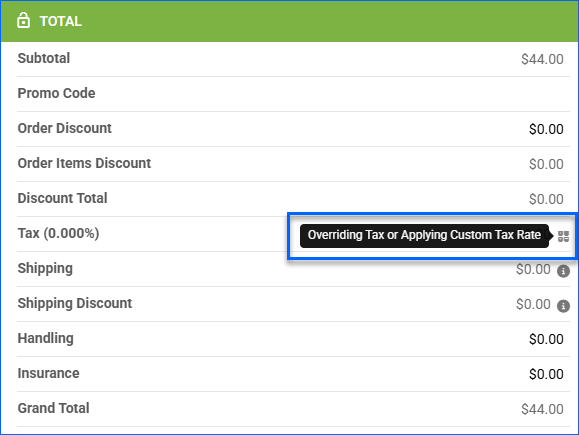

To apply tax to an order manually:

- Go to the Order Details Page.

- Click Edit.

- In the Total field, click the Overriding Tax or Applying Custom Tax Rate icon to the right of the Tax field.

- In the Taxes pop-up:

- Click Save.

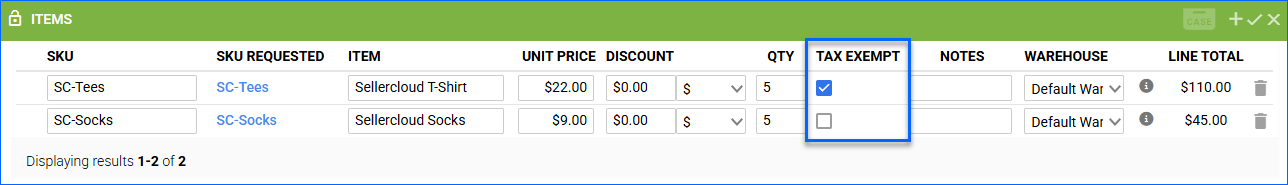

To set an order item as tax-exempt on a single order:

- Go to the Order Details Page.

- Click Edit.

- In the Items panel, check Tax Exempt for the appropriate SKU.

- Click Save.

Via Plugin

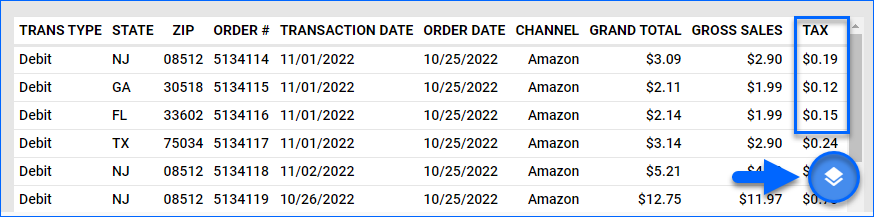

With the Generic Order Tax Import plugin, you can import order taxes directly from a file. This is especially useful for synchronizing Sellercloud with external tax calculation services.

To import order tax, prepare a Comma-Separated Values (CSV) file with the following headers:

- OrderID – The order number.

- Tax – The order’s total tax amount.

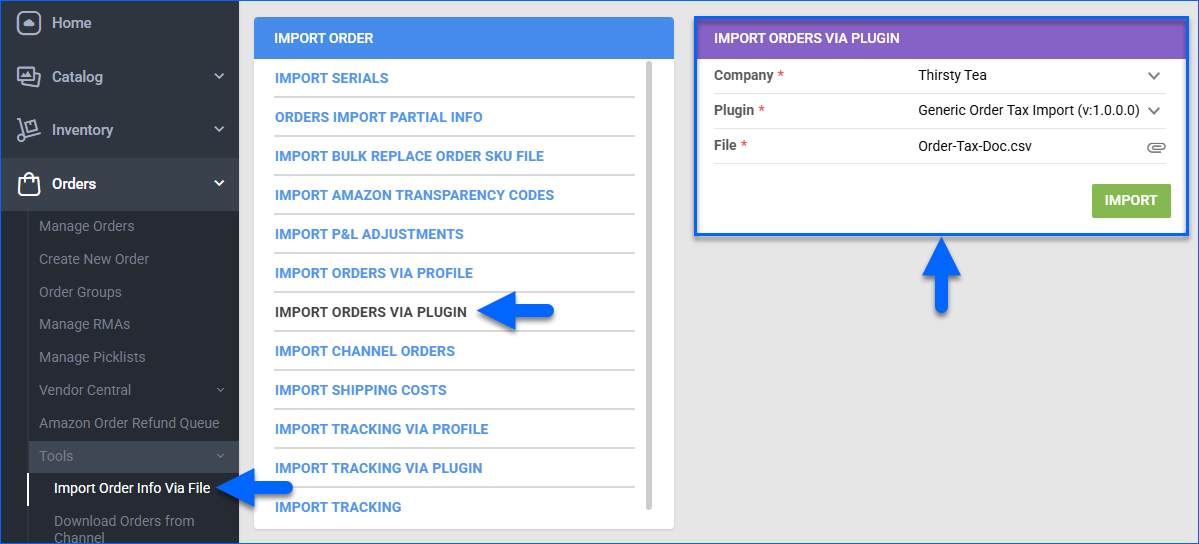

To upload your file:

- Go to Orders > Tools > Import Order Info Via File > Import Orders Via Plugin.

- Select appropriate Company.

- Select the Generic Order Tax Import plugin.

- Select the File and click Upload.

Via Import Mapping Profile

An Import Mapping Profile allows you to import information into Sellercloud from files (Excel, CSV, or Tab Delimited) with columns that are not the same as the standard Sellercloud fields.

First, follow the steps to create an Import Mapping Profile. The following Import Mapping Columns allow you to import order and customer tax details:

- Order_Tax – The total tax for an entire order.

- Order_Item_Tax – The tax associated with a specific item in an order.

- Customer_TaxID – The tax identification number of the customer.

- Customer_TaxExempt – Indicates whether the customer is tax-exempt.

- Customer_TaxExemptType – The type of tax exemption for the customer.

Next, using the mapping profile, you can:

- Import Order Information manually.

- Import Customer Information manually.

- Import order or customer information automatically with a Scheduled Task.

Review and Export Order Tax

You can export tax amounts from the Reports or with a Scheduled Task combined with an Export Mapping.

Via Reports

The following are some of the reports showing tax data:

- Tax Collected by Transaction – Breaks down sales tax collected per transaction across channels and jurisdictions. Tax columns: Taxable Sales, Non-Taxable Sales, Tax Rate, Tax Collected, Paid by Channel, and Tax Due.

- Tax Collected by Settlement – Summarizes tax collected per settlement report (e.g., Amazon, Walmart). Tax columns: Taxable Sales, Tax Collected, Tax Refunded, Marketplace Facilitator Tax, and Tax Due.

- Transaction Summary – Summarizes order-level transaction data across a date range. Tax columns: Tax Collected, Tax Refunded, Marketplace Facilitator Tax, Paid by Channel, and Tax Due

- Sales Summary – Summarizes sales totals by channel or company. Tax columns: Tax, Shipping Tax, and Tax Refunded.

- Product Profit Summary – Summarizes profitability per product. Tax columns: Taxable Sales, Tax Collected, and Tax Due.

- Orders Summary by Date Range – Summarizes orders grouped by customer, company, or channel. Tax columns: Tax, Shipping Tax, Tax Refunded.

- Orders Detail by Date Range – Shows full order-level breakdown including cost, revenue, and profit. Tax columns: Tax.

- P&L Order Summary by Transaction – Displays profit and loss metrics per transaction. Tax columns: Tax.

You can review the data in the reports’ web interface or export it to a spreadsheet by clicking the Actions icon on the bottom right and selecting Export to Excel.

Via Export Mapping Profile

An Export Mapping Profile allows you to export information to a file (format Excel, CSV, or Tab Delimited) with columns that are different from the standard Sellercloud fields.

First, follow the steps to create an Export Mapping Profile. The following Export Mapping Columns allow you to export customer and order tax details:

Order Details

- bvc_Order.TaxTotal – The total tax amount charged on the entire order.

- bvc_Order.TaxRate – The tax rate applied to the order.

- bvc_Order.ForceUseFixedTaxAmount – Indicates if a fixed tax amount overrides the calculated tax for the order.

- bvc_Order.lsTaxCollectedByMarketplace – Indicates if the tax was collected by a marketplace facilitator (e.g., Amazon, Walmart).

Order Item Details

- bvc_Orderltem.TaxClass – The tax classification of the item, used to determine applicable tax rules (e.g., general merchandise, clothing, food).

- bvc_OrderItem.TaxExempt – Indicates if the item is tax-exempt.

- bvc_Orderltem.LineTaxTotal – The total tax charged on a specific item line.

- bvc_Orderltem.ShippingTax – The amount of tax applied to the shipping charge associated with the item.

- bvc_Orderltem.PackingSlipTax – The amount of tax applied to any fees related to packing slips.

- bvc_OrderItem.GiftWrapTax – The amount of tax applied to the gift wrap service for this item.

Integrations

- bvc_Order.TaxSubmittedToAPI – Indicates if the tax for the order has been submitted to an external tax service.

- bvc_Order.TaxSubmittedToAPIOn – The date and time when the tax submission occurred.

- bvc_Order.TaxSubmittedToAPIFailureCount – The number of failed attempts to submit the tax.

- bvc_Order.TaxTotalFromTaxAPI – The total tax amount returned from the external tax API.

- bvc_Order.TaxTotalFromTaxAPIDismissed – Indicates if the returned tax value from the external API was dismissed in favor of Sellercloud’s calculation or a manually set value.

Next, using the mapping profile, you can:

- Export Order Information manually.

- Export order information automatically with a Scheduled Task.

Related Client Settings

The following Client Settings control tax behavior:

General Settings

- Stop Calculating Taxes For LocalStore Orders – Enable this setting to prevent Sellercloud from calculating taxes for Local Store orders.

- Stop Calculating Taxes For WholeSale Orders – Enable this setting to prevent Sellercloud from calculating taxes for Wholesale Orders.

- Stop Calculating Taxes For Website Orders – Enable this setting to prevent Sellercloud from calculating taxes for Website Orders. It’s recommended to keep this setting enabled, as website taxes are typically calculated outside of Sellercloud and then automatically imported.

- Charge Tax on Shipping – Include shipping charges in the taxable amount for orders.

- Charge Tax on Gift-Wrap – Include Gift Wrap charges in the taxable amount for orders.

- Display Tax Code On Product Home Page – Display the Tax Code field in the Details panel on the Product Details Page.

Integrations

- Stop Removing Taxes From eBay Orders – Retain any tax amounts included in eBay orders instead of automatically removing them from orders. eBay is responsible for collecting and remitting taxes.

- Apply Tax While Importing Vendor Central Check Availability Via Queued Job – Calculate and apply tax when checking inventory availability for Amazon Vendor Central.

- Enable Tax API Per Channel PerState – This setting allows you to select unique states for each channel on the Company Settings > Taxes API page. This is a prerequisite for the TaxJar account integration workflow.