Overview

A marketplace facilitator is a marketplace that contracts with third-party sellers to facilitate the promotion and sale of physical goods, digital products, and services on its platform. Many marketplace facilitators like Amazon, Etsy, Walmart, and eBay are now required to collect and remit sales tax on behalf of their sellers and are subject to marketplace facilitator tax laws.

States with Marketplace Facilitator Tax Laws

At this point, most states in the U.S. have adopted marketplace facilitator tax laws. See this page for a complete list of states that have adopted Marketplace Facilitator Tax Laws and their effective date.

Keep Track of Marketplace Tax in Sellercloud

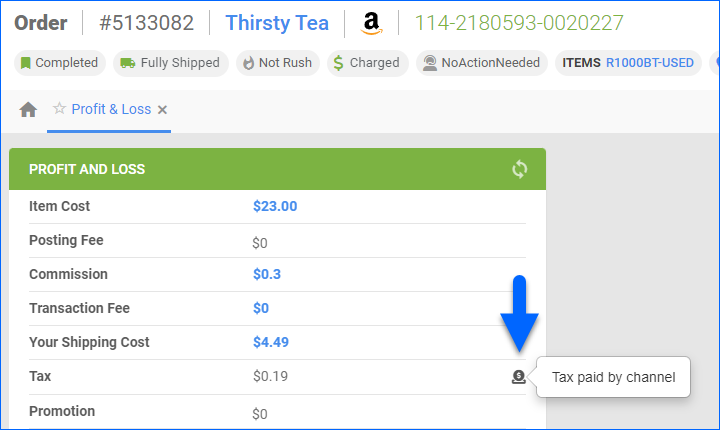

In Sellercloud, when a marketplace collects the tax, the amount will get flagged to reflect this fact. You can see it on the orders’ Profit & Loss tab, marked with a Tax paid by channel icon.

In addition, the following Sellercloud reports log marketplace facilitator tax information:

For step-by-step instructions on using the reports to keep track of sales tax, click the links above.

Post Marketplace Facilitator Tax to Quickbooks

When you post sales using the Post General Journal Entries options, there’s an additional Journal entry type called Marketplace Facilitator Tax. This entry type reflects the tax amounts collected by the marketplace and can be mapped to balance out the amounts collected by the channel included in the journal entry for taxes.

Post Marketplace Facilitator Tax for Detailed Shipped Orders

Generally, when you post detailed shipped orders as invoices, the sales tax gets posted as an additional Sales Tax Item line item. This line item gets mapped to the related accounts in your Quickbooks Item List to reflect tax amounts that must be remitted to their respective tax agencies.

However, with Quickbridge’s Marketplace Facilitator Tax settings in the Sales Order tab, the tax can be posted as an Other Charge Item when enabled for the respective channels. This will reflect that the marketplace collected and remitted these amounts to the respective tax agencies.

Settings Configuration

Configure your Quickbridge settings as follows:

- Navigate to Options > Sales Orders, and uncheck Post All Payments to Undeposited Funds Account.

- Navigate to Options > Sales Orders, and uncheck Mark Sales Orders as UnPaid for all Channels.

- Navigate to Options > Main, and set the Mark Orders Paid to Always Paid for the specific channel.

The following Items will be created as Other Charge Items in your Quickbooks Item List, with income accounts mapped to their respective channel interim accounts:

- Amazon Facilitator Tax

- Walmart Facilitator Tax

- eBay Facilitator Tax