Overview

When calculating your Profit & Loss in Sellercloud, you can choose between Accrual and Cash basis accounting. The key difference lies in the timing of acknowledging revenue and costs for an order.

Cash Basis accounting recognizes revenue only after payment is received, based on the Amount Paid. In contrast, the Accrual Basis recognizes revenue when the order is placed, taking into account the Order’s Grand Total instead, regardless of when the payment is received.

Configure Accounting Basis

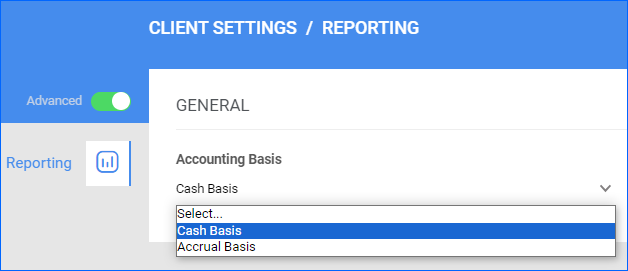

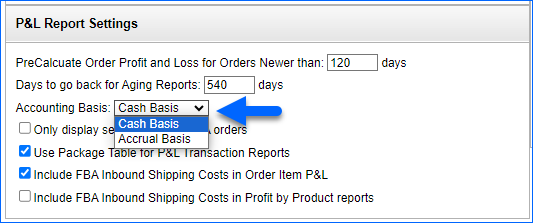

To configure your Accounting Basis, select either Accrual or Cash in Settings > Client Settings > Reporting.

Accrual Basis

When you choose Accrual Basis, the profit for an order is recorded at the time the order is placed, regardless of when the payment is received. Opt for an Accrual Basis to utilize the Accrual Profit calculation method when generating the P&L report for an order.

When the Accrual Basis method is selected, the profit for an order is calculated as follows:

- (Grand Total Amount – Return Grand Total Amount) – (Item Cost + Total Fees Amount)

Cash Basis

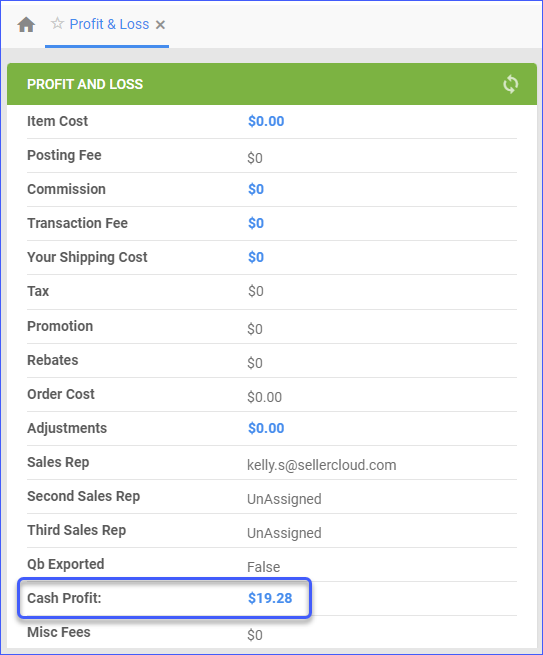

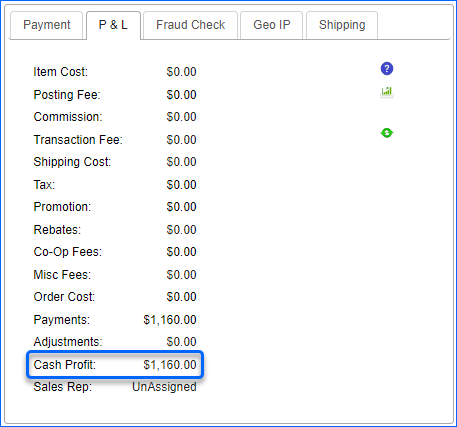

When you choose Cash Basis, the profit for an order is recorded upon the receipt of payment for that particular order. Opt for the Cash Basis to utilize the Cash Profit calculation method when generating the P&L report for an order.

When the Cash Basis method is selected, the profit for an order is calculated as follows:

- (Total Payment Amount – Total Refund Amount) – (Item Cost + Total Fees Amount)

Track Profit on Orders

The value of the Accounting Basis setting will affect how Profit & Loss is calculated for each order.

- Go to Orders > Manage Orders > Open the desired order.

- Click Toolbox, and select Profit & Loss.

For an in-depth understanding of the order-level Profit & Loss, refer to Order Profit & Loss Overview.

For an in-depth understanding of the order-level Profit & Loss, refer to Order Profit & Loss Overview.

Overview

When calculating your Profit & Loss in Sellercloud, you can choose between Accrual and Cash basis accounting. The key difference lies in the timing of acknowledging revenue and costs for an order.

Cash Basis accounting recognizes revenue only after payment is received, based on the Amount Paid. In contrast, the Accrual Basis recognizes revenue when the order is placed, taking into account the Order’s Grand Total instead, regardless of when the payment is received.

Configure Accounting Basis

To configure your Accounting Basis, select either Accrual or Cash in Settings > Client Settings.

Accrual Basis

When you choose Accrual Basis, the profit for an order is recorded at the time the order is placed, regardless of when the payment is received. Opt for an Accrual Basis to utilize the Accrual Profit calculation method when generating the P&L report for an order.

When the Accrual Basis method is selected, the profit for an order is calculated as follows:

- (Grand Total Amount – Return Grand Total Amount) – (Item Cost + Total Fees Amount)

Cash Basis

When you choose Cash Basis, the profit for an order is recorded upon the receipt of payment for that particular order. Opt for the Cash Basis to utilize the Cash Profit calculation method when generating the P&L report for an order.

When the Cash Basis method is selected, the profit for an order is calculated as follows:

- (Total Payment Amount – Total Refund Amount) – (Item Cost + Total Fees Amount)

Track Profit on Orders

The value of the Accounting Basis setting will affect how Profit & Loss is calculated for each order.

- Go to Orders > Manage Orders > Open the desired order.

- Click Toolbox, and select Profit & Loss.

For an in-depth understanding of the order-level Profit & Loss, refer to Order Profit & Loss Overview.

For an in-depth understanding of the order-level Profit & Loss, refer to Order Profit & Loss Overview.