Overview

Sellercloud is integrated with TaxJar, which offers sales tax reporting and filing for online retailers. This API integration provides two major benefits:

- Accurate, hassle-free tax filing – Orders from all sales channels are uploaded automatically to TaxJar for accurate filing with state tax agencies nationwide.

- Accurate P&L reporting – TaxJar captures both the total amount paid for the order and the individual line items and subsequently analyzes and itemizes each line item separately.

Prerequisites

TaxJarService must be enabled for this workflow! Contact Sellercloud Support to ensure that this service is installed on your server.

Before you can configure TaxJar, follow these steps:

- Navigate to Client Settings and make sure Enable Tax API Per Channel PerState is enabled.

- Find your TaxJar API Token required to authenticate in Sellercloud.

Configure Automatic Order Submission to TaxJar

TaxJar currently supports a single business entity for each TaxJar account. This means you can connect multiple websites/stores/carts to a single account as long as you file single, consolidated returns for all companies/stores under the same business entity. However, you can use the same TaxJar account for multiple Companies in Sellercloud.

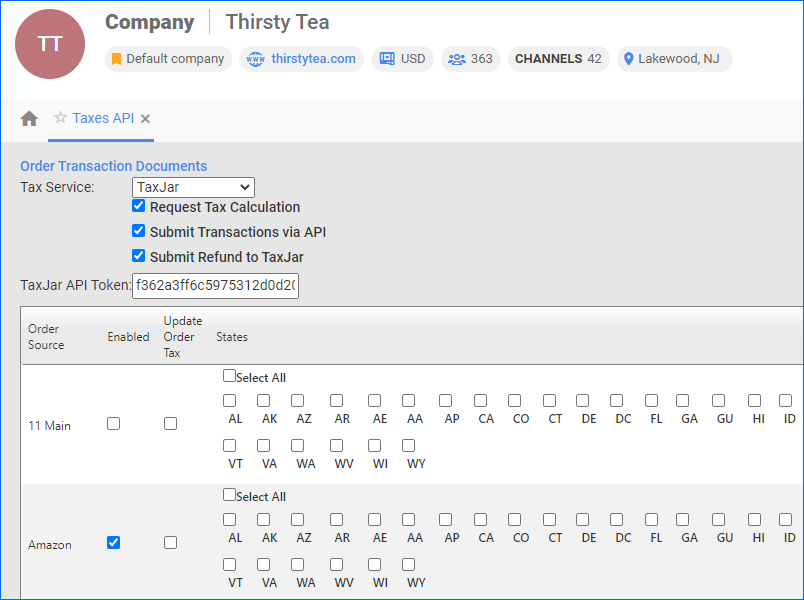

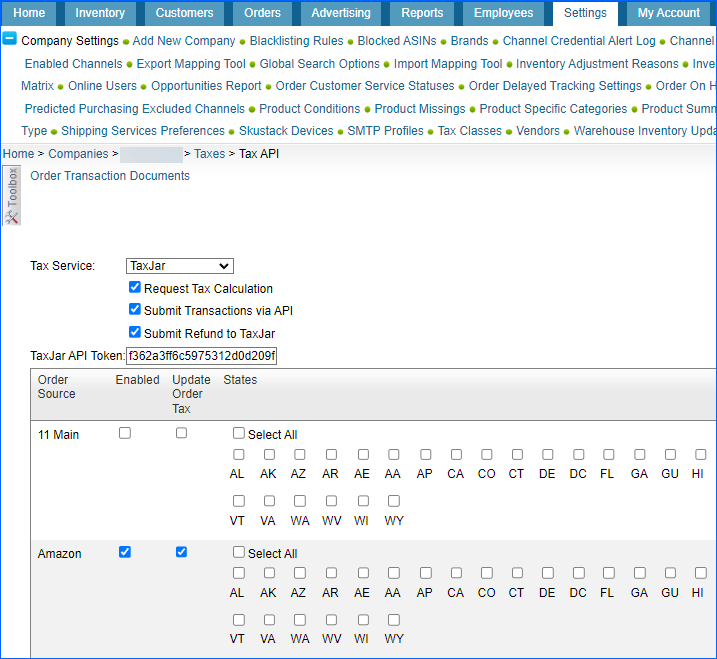

To configure TaxJar for automatic order submission:

- Go to Company Settings.

- Click Toolbox and select Taxes > Taxes API.

- Set the Tax Service to TaxJar.

- Enter the TaxJar API Token.

- Check the boxes under Enabled to enable each relevant channel.

- For each channel, select the relevant States for which you are collecting taxes. There may be different tax collection rules for different channels.

- Check Submit Transactions via API to allow Sellercloud to send orders to TaxJar automatically.

- Check Submit Refund to TaxJar to allow Sellercloud to automatically send refunds to TaxJar automatically for any orders originally sent from Sellercloud.

- Check Request Tax Calculation to allow Sellercloud to request TaxJar tax data and update the API Tax column for orders automatically.

- For each channel, you can check Update Order Tax to override the current tax amount with the tax amount from TaxJar. Never use it with marketplace channels! Use it only with Website, Wholesale, or Local Store channels.

- When you are done, click Save at the bottom.

Sellercloud uploads orders in scheduled intervals based on when your server’s TaxJarService runs. If you need to send orders older than seven days that have not been sent yet, use the manual action Post to TaxJar on the Manage Orders page.

Manual Actions

You can send orders and get tax from TaxJar per order manually.

Get Tax

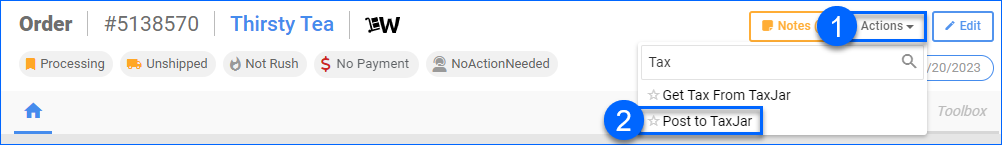

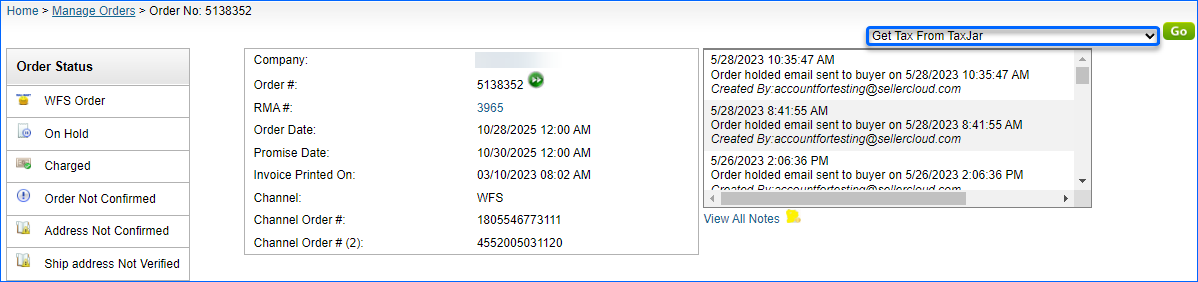

To request a tax calculation for one order:

- Go to an Order Details page.

- Click Actions > Get Tax From TaxJar.

This option works even with the Request Tax Calculation setting (which automatically requests TaxJar tax data for orders) turned off.

Send Orders

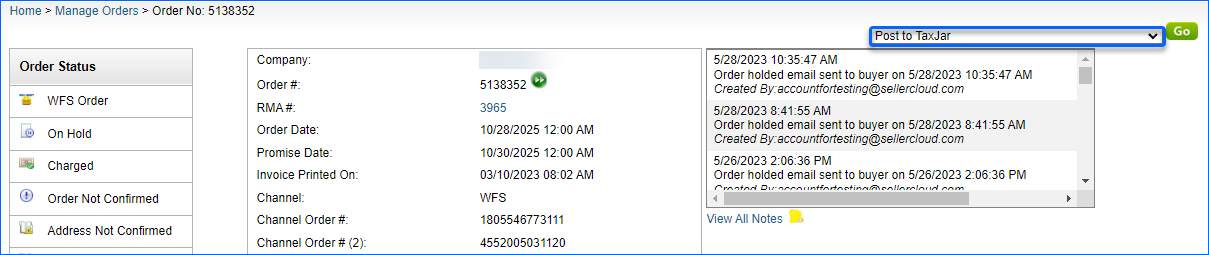

To send one order to TaxJar:

- Go to an Order Details page.

- Click Actions > Post to TaxJar.

This is useful if you need to send any orders that are older than seven days and have not been sent automatically by Sellercloud yet.

Tax Exemptions and Tax Codes

You can set tax codes and tax exemptions per customer and per product.

Customer Tax Codes and Exemptions

App Setting EnableCreateTaxJarCustomer must be enabled for this feature! Contact Sellercloud Support to ensure that this setting is enabled for your account.

Before sending an order to TaxJar, Sellercloud creates the Customer if they’re not added yet.

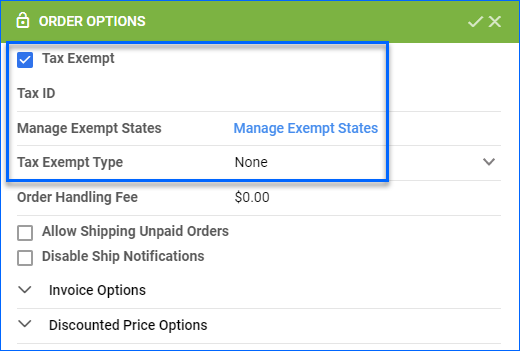

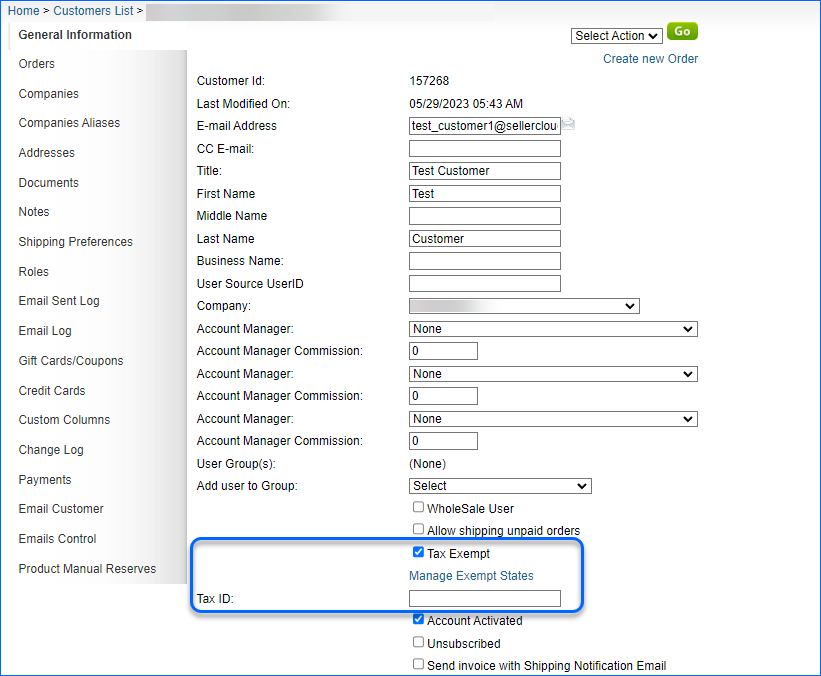

To set a customer as tax-exempt:

- Go to Customers > Manage Customers.

- Click a customer.

- Click Edit.

- To set the customer as tax-exempt in the Order Options panel:

- Check Tax Exempt.

- To enter a tax code, use the Tax ID field.

- Set the Tax Exempt Type.

- Optionally, Manage Exempt States.

- Click Save.

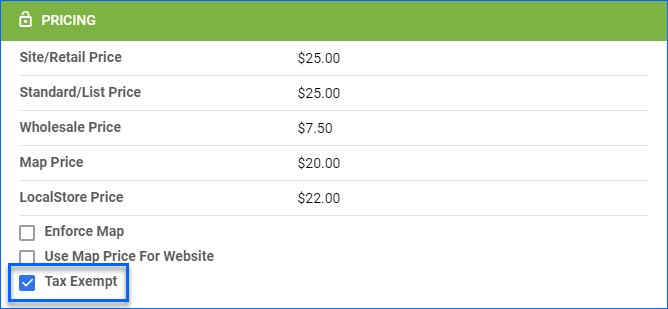

Product Tax Codes and Exemptions

To set up products as tax-exempt:

- Go to a Product Details Page.

- Click Edit.

- To set the product as tax-exempt, use the Tax Exempt checkbox in the Pricing section.

- Click Save.

API Mismatch

You can see tax changes on the Tax API Mismatch page. This page is currently available in Sellercloud’s Alpha user interface.

To apply or dismiss changes to any order’s tax:

- Click Orders > Order Reports > API Tax Mismatch.

- The grid lists orders with the tax changes. Select one or more orders and click Select Action.

- Select Update Tax on Order or Dismiss Selected. The order will disappear from the grid, and the following occurs:

- A note is created in an updated order

- Profit and Loss will update immediately on the order’s P&L tab

- Reports will update after the P&L service runs daily at approximately 2:00 AM EST

Even if you don’t update the order with the tax amount from TaxJar, you can still see the tax amount in the Tax Collected by Transaction report in the column called API Tax. Note that the Client Setting Enable Tax API Per Channel PerState must be turned on for this column to appear.

Overview

Sellercloud is integrated with TaxJar, which offers sales tax reporting and filing for online retailers. This API integration provides two major benefits:

- Accurate, hassle-free tax filing – Orders from all sales channels are uploaded automatically to TaxJar for accurate filing with state tax agencies nationwide.

- Accurate P&L reporting – TaxJar captures both the total amount paid for the order and the individual line items and subsequently analyzes and itemizes each line item separately.

Prerequisites

TaxJarService must be enabled for this workflow! Contact Sellercloud Support to ensure that this service is installed on your server.

Before you can configure TaxJar, follow these steps:

- Navigate to Settings > Client Settings and make sure Enable Tax API Per Channel PerState is Enabled.

- Find your TaxJar API Token required to authenticate in Sellercloud.

Configure Automatic Order Submission to TaxJar

TaxJar currently supports a single business entity for each TaxJar account. This means you can connect multiple websites/stores/carts to a single account as long as you file single, consolidated returns for all companies/stores under the same business entity. However, you can use the same TaxJar account for multiple Companies in Sellercloud.

To configure TaxJar for automatic order submission:

- Go to Company Settings.

- Click Toolbox and select Taxes > Taxes API.

- Set the Tax Service to TaxJar.

- Enter the TaxJar API Token.

- Check the boxes under Enabled to enable each relevant channel.

- For each channel, select the relevant States for which you are collecting taxes. There may be different tax collection rules for different channels.

- Check Submit Transactions via API to allow Sellercloud to send orders to TaxJar automatically.

- Check Submit Refund to TaxJar to allow Sellercloud to automatically send refunds to TaxJar automatically for any orders originally sent from Sellercloud.

- Check Request Tax Calculation to allow Sellercloud to request TaxJar tax data and update the API Tax column for orders automatically.

- For each channel, you can check Update Order Tax to override the current tax amount with the tax amount from TaxJar. Never use it with marketplace channels! Use it only with Website, Wholesale, or Local Store channels.

- When you are done, click Save at the bottom.

Sellercloud uploads orders in scheduled intervals based on when your server’s TaxJarService runs. If you need to send orders older than seven days that have not been sent yet, use the manual action Post to TaxJar on the Manage Orders page.

Even with TaxJar, it is still a good idea to configure tax rates on the Taxes page so you can see the tax amount while creating a local order.

Manual Actions

You can send orders and get tax from TaxJar per order manually.

Get Tax

To request a tax calculation for one order:

- Go to the Order Details page.

- Click Actions > Get Tax From TaxJar.

This option works even with the Request Tax Calculation setting (which automatically requests TaxJar tax data for orders) turned off.

Send Orders

To send one order to TaxJar:

- Go to the Order Details page.

- Click Actions > Post to TaxJar.

This is useful if you need to send any orders that are older than seven days and have not been sent automatically by Sellercloud yet.

Tax Exemptions and Tax Codes

You can set tax codes and tax exemptions per customer and per product.

Customer Tax Codes and Exemptions

App Setting EnableCreateTaxJarCustomer must be enabled for this feature! Contact Sellercloud Support to ensure that this setting is enabled for your account.

Before sending an order to TaxJar, Sellercloud creates the Customer, if they’re not added yet.

To set a Customer as tax-exempt:

- Go to Customers and select a customer.

- Click Edit.

- To set the customer as tax-exempt:

- Check Tax Exempt.

- To enter a tax code, use the Tax ID field.

- Optionally, Manage Exempt States.

- Click Save.

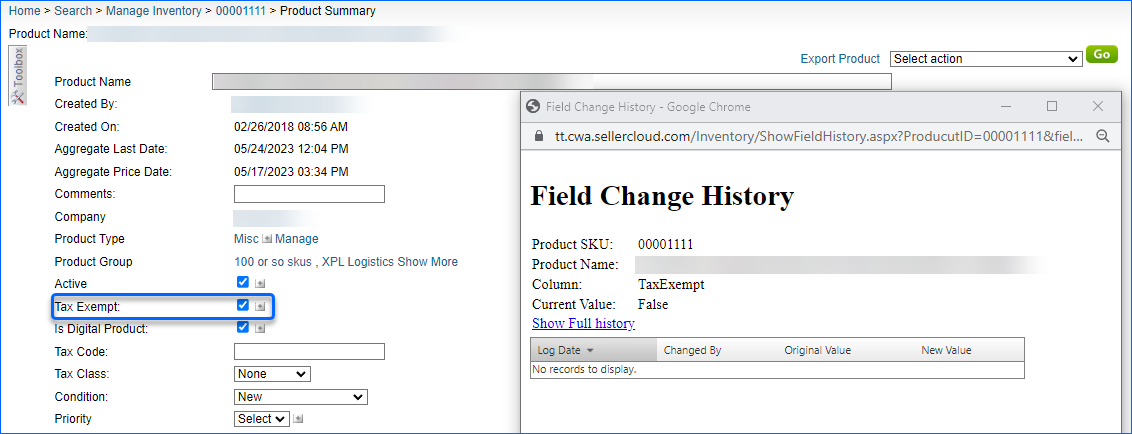

Product Tax Codes and Exemptions

To set up products as tax-exempt:

- Go to Inventory > Manage Inventory and select a product.

- To set the product as tax-exempt, use the Tax Exempt checkbox. You can view the Field Change History, if you click on the plus sign.

- Click Save Product.

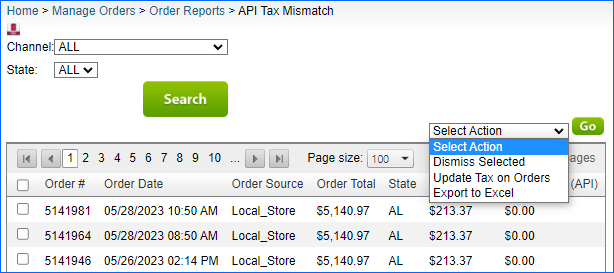

API Mismatch

You can see tax changes on the API Tax Mismatch page.

To apply or dismiss changes to any order’s tax:

- Click Orders > Order Reports > API Tax Mismatch.

- The grid lists orders with the tax changes. Select a Channel and one or more orders, then click Select Action.

- Select Update Tax on Order or Dismiss Selected. The order(s) will disappear from the grid, and the following occurs:

- A note is created in an updated order.

- Profit and Loss will update immediately on the order’s P&L tab.

- Reports will update after the P&L service runs daily at approximately 2:00 AM EST.

Even if you don’t update the order with the tax amount from TaxJar, you can still see the tax amount in the Tax Collected by Transaction report in the column called API Tax. Note that the Client Setting Enable Tax API Per Channel PerState must be turned on for this column to appear.