Overview

In this article, you will learn about Sellercloud’s Sales Summary Report, which provides a detailed analysis of your sales data for a selected date or date range. You can summarize the report by:

- Channel

- Company

- Manufacturer

- Order Date

- Product Group

- Product Type

- Purchaser

- Sales Rep

- Ship Date

- Ship From Warehouse

- Vendor

- Wholesale Customer

The report includes key metrics, such as:

- Sales: Units Sold and Number of Orders (When filtering by Channel or Company).

- Revenue: Payment, Subtotal, Grand Total, Shipping, etc.

- Profit: Profit and Profit Margin.

- Costs: Items Cost, Total Fees, etc.

- Refunds: Cash Refunds or Accrual Refunds, Tax Refunds, etc.

Access and Customize the Report

To use the report:

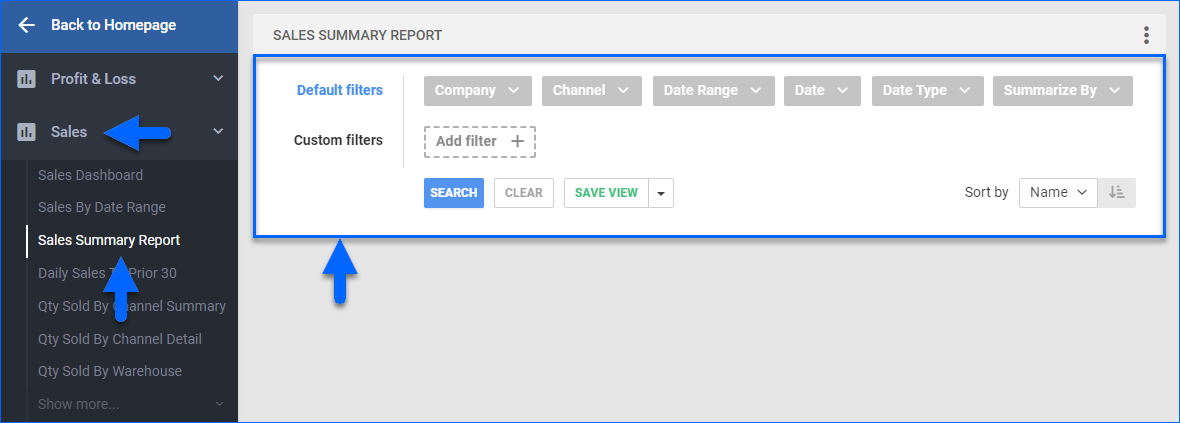

- Go to Reports > Sales > Sales Summary Report.

- Select your date filters (Date Range or Date), and choose the right Date Type filter for your search. This filter affects which orders are returned by the search. Select Order to see sales data for orders placed in the selected range or Ship to see sales data for orders shipped in the selected range.

- Set up the other Default or Custom filters for the report to show precisely what you need.

- Click Search. Each filter you apply is highlighted in orange, and it turns green after you click Search. If a filter is gray or not displayed at all, it’s not active.

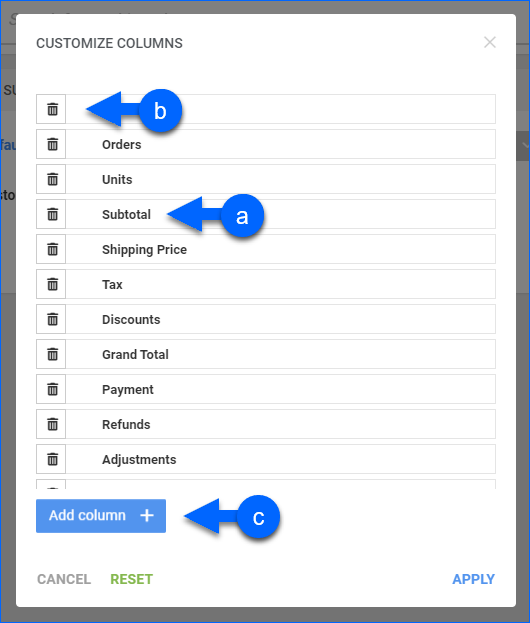

- To manage the columns in the report, click the three dots icon on the top right and select Customize Columns. This report allows showing up to 19 columns at a time. You can:

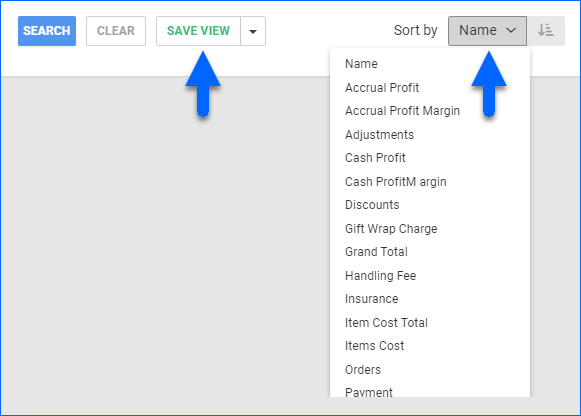

- To sort the data differently, use the Sort by menu.

- To save your filtering and sorting options, click Save view, type a Name, and click Save.

- To export the full report to a spreadsheet, click Actions on the bottom right and select Export to Excel. You can also export to CSV or PDF. Exports always include all columns, even those hidden in the grid due to the 19-column limit.

Filter Definitions

Default Filters

| FILTER | DESCRIPTION |

| Company | Include only orders from one or more Companies. |

| Channel | Include only orders from one or more Channels. |

| Date Range | Select a preset time range from Yesterday to Last Year. |

| Date | Enter the Start and End dates. For a single date, choose the same Start and End date. |

| Date Type | Choose a date type based on which orders and their associated activity appear in the report:

|

| Summarize By | Choose how to summarize sales in the report. Your choice will determine the grouping of the sales data. |

Custom Filters

| FILTER | DESCRIPTION |

| Accounting Basis | Choose how your profit is calculated. This filter also affects which columns appear in the report. See Report Data for more information.

|

| Brand | Include sales data only for products from one or more Brands. |

| Company Groups | Include sales data only for orders from one or more Company Groups. |

| Manufacturer | Include sales data only for products from one or more Manufacturers. |

| Order # | Include sales data only for specific order(s). |

| Product Groups | Include sales data only for products from one or more Product Groups. |

| Product Type | Include sales data only for products from one or more Product Types. |

| Purchaser | Include sales data only for products with a specific user assigned as Purchaser. |

| Settlement Status | Include sales data for Amazon, FBA, Walmart Marketplace, and WFS orders in one of two ways:

|

| Show Precise Item Cost | Show the precise item cost up to 4 decimal places. |

| Vendor | Include only products that have their Default Vendor set to any of the selected. For Dropship orders, this will be the vendor from which the products were purchased. |

Report Data

| COLUMN | FIELD DATA | DESCRIPTION |

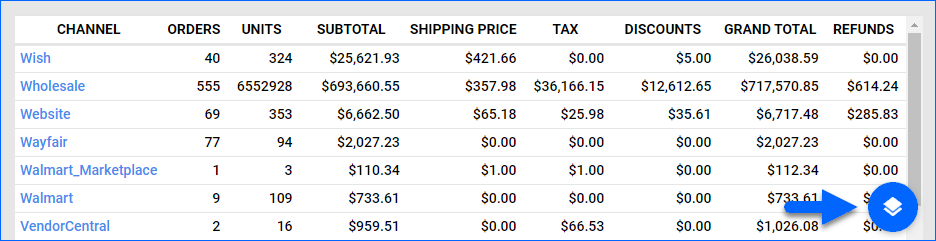

| Name of Summarize By | N/A | Shows how you are grouping the report data based on the Summarize By filter. This can be the Channel, Company, Manufacturer, etc. |

| Orders | Count of OrderID | Shows the total number of orders. If the Date Type is: Order – The total number of orders placed in this date range. Ship – The total number of orders shipped in this date range. |

| Units | Sum of Qty | Shows the number of product units sold. If the Date Type is: Order – The total number of product units on orders placed in this date range. Ship – The total number of product units on orders shipped in this date range. |

| Subtotal | Sum of SubTotal | Shows the total amount of the items before any discounts, tax, shipping, etc. |

| Shipping Price | Sum of Shipping Price | The total amount paid for shipping all orders. |

| Tax | Sum of Tax Amount | The total tax collected for orders. |

| Discounts | Sum of Discount | Shows the total amount of all discounts applied to the orders. |

| Adjustments | Sum of P&L Adj | The sum of all positive and negative adjustment amounts applied to orders. P&L Adjustments in Sellercloud include any post-sale transactions that adjust your Profit and Loss after the initial sale (e.g. Reimbursements, Shipping Claims, Return Labels, etc.). |

| Items Cost | Sum of Item Cost | The sum of the Item Cost on sales minus the Item Cost on Returns received on orders shipped or placed in this date range. Based on the item cost on the date of the order and the calculation method selected in the client setting Order Profit & Loss Calculated Using. For more information, see Order Item Cost Calculation. |

| Item Cost Total | Sum of Total Cost | Shows the sum of all item costs, as well as any other order-related costs, calculated as: (Item Cost – Rebate + Shipping Cost + Commission + Transaction Fee + Posting Fee + Dropship Fee + Co-Op Fee + Tax). |

| Total Fees | Sum of all Fees | Shows the total sum of all fees incurred for the orders, including Shipping cost, Commission, Transaction Fees, Posting Fees, Dropship Fees, Co-op Fees, and Tax Payable. |

| Shipping Cost | Sum of Original Shipping Cost | Shows the sum of all costs for outbound shipping.

|

| Gift Wrap Charge | Sum of Gift Wrap | The sum of charges for gift wrapping orders charged to the customer. |

| Handling Fee | Sum of Handling | The sum of all handling fees charged to the customer. |

| Insurance | Sum of Insurance | Shows the total amount charged to customers for order insurance. |

| Shipping Discount | Sum of Shipping Discount | Shows the sum of all shipping discounts. |

Accounting-Specific Columns

The following columns appear by default depending on your configuration of a Client Setting called Accounting Basis. However, you can change which columns appear anytime by updating the Custom Filter, also called Accounting Basis. For more information, see Order Profit Calculation – Cash vs Accrual.

Cash Columns

These columns appear only if you set the Accounting Basis Custom Filter to Cash:

| COLUMN | FIELD DATA | DESCRIPTION |

| Cash Profit | (Payment – Refunds + Adjs) – TotalCost | The sum of your profit from all orders, recorded when the payment is received and based on the amount the buyer paid. |

| Cash Profit Margin | Cash Profit / (Payment – Refunds + Adjs) | Your overall profit margin from all orders, based on the received payments. |

| Payment | Sum of Payments | Shows the sum of the actual amounts the buyers paid (usually the same amount as the Grand Total unless there is an underpayment or overpayment). |

| Refunds | Sum of Refunds | Shows the total refund amount from all orders. |

| *Tax Refunds | Sum of Tax Refunds | The amount of tax refunded for all orders. |

Accrual Columns

These columns appear only if you set the Accounting Basis Custom Filter to Accrual:

| COLUMN | FIELD DATA | DESCRIPTION |

| Accrual Profit | (Grand Total – Returns Grand Total) – Total Cost | The sum of your profit from all orders, recorded at the time of order based on the Grand Total. |

| Accrual Profit Margin | Accrual Profit / (Grand Total – Returns Grand Total) | Your overall profit margin from all orders, based on the Grand Total. |

| Grand Total | Sum of Grand Total | Shows the sum of all orders’ Grand Total minus the sum of the Grand Total of Returned Items.

|

| Accrual Refunds | Sum of Accrual Refunds | Shows the Grand Total on items returned from all orders. |

| *Accrual Tax Refunds | Sum of Accrual Tax Refunds | The original tax amount for items that have now been returned. |

You can add columns listed with an asterisk (*) to the grid by following the instructions outlined in step 5 of the Access and Customize the Report section.