Overview

In this article, you will learn about Sellercloud’s Transaction Details by Date report. This report provides a detailed overview of all transactions made in the specified date range and shows the financial performance of your business.

It includes financial information and order details, as well as information about the product, channel, and company:

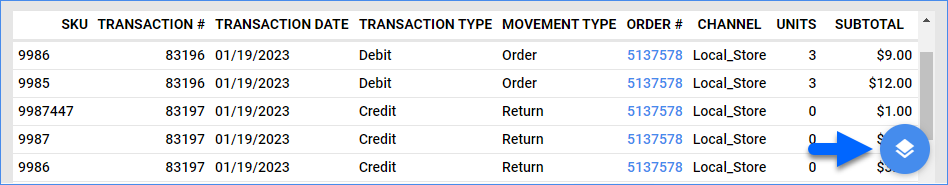

- Financial Summary: Subtotal, Shipping, Tax, Grand Total, Payments, Refunds, Adjustments, Items Cost, Commission, Transaction Fee, Total Fees, Other Channel Fees, Accrual Profit, Cash Profit, Accrual Profit Margin, Cash Profit Margin, Coop Fee, Discount, Dropship Fee, and Gift Wrap.

- Order Details: Transaction Number, Transaction Date, Transaction Type, Movement Type, Order Number, Channel, Channel Order Numbers, Order Subtype, and Quantity.

- Product Details: Company, SKU, ASIN, and Brand.

Access and Customize the Report

To use the report, follow these steps:

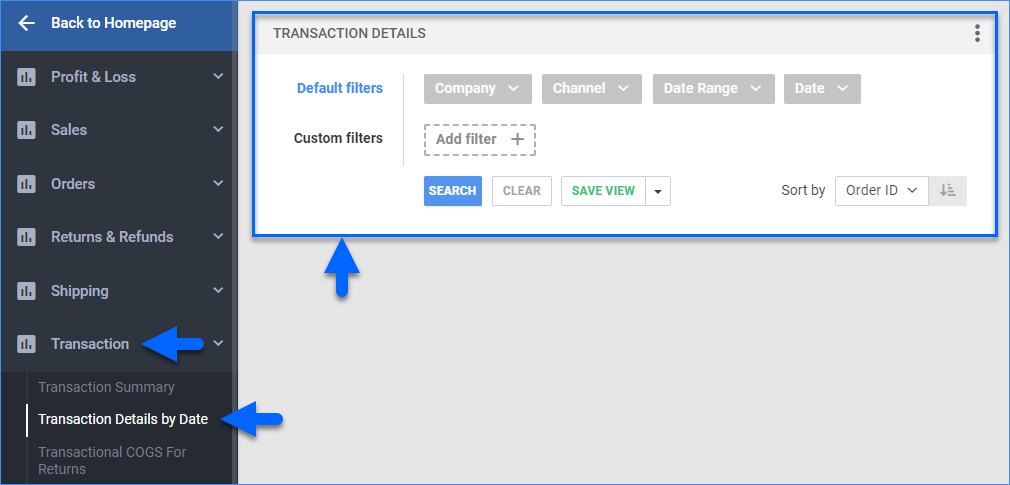

- Navigate to Reports > Transaction > Transaction Details by Date.

- Set up the Default and Custom filters to have the report show precisely what you need.

- Click Search. Each filter you apply gets highlighted in green. If a filter is gray or not displayed at all, it’s not active.

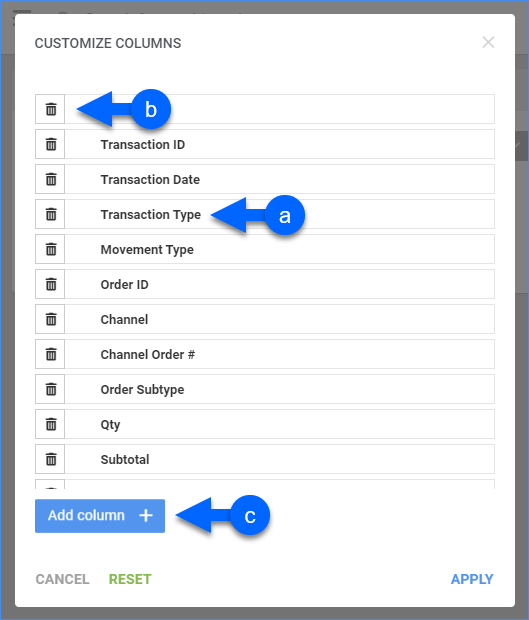

- To manage the columns in the report, click the three dots icon on the top right and select Customize Columns. You can:

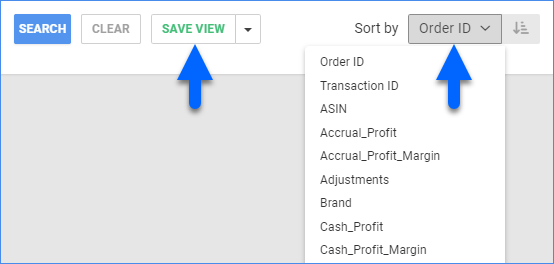

- To sort the data differently, use the Sort by menu.

- To save your filtering and sorting options, click Save view, type a Name and click Save.

- To export the full report to a spreadsheet, click Actions on the bottom right and select Export to Excel. Spreadsheets include all columns, including those hidden in the report.

Filter and Column Definitions

Click the drop-downs below for filter and column descriptions.

| FILTER | DESCRIPTION |

| Company | Include only transactions from one or more companies. |

| Channel | Include only transactions from one or more sales channels. |

| Date Range | Select a preset time range from Yesterday to Last Year. |

| Date | Enter the Start and End dates. For a single date, choose the same Start and End date. |

| FILTER | DESCRIPTION |

| Accounting Basis | Choose between:

|

| Company Groups | Include only products from one or more company groups. |

| Manufacturer | Include only products from one or more manufacturers. |

| Movement Type | Include only specific movement types (Order, PO, etc.). |

| Order # | Filter by specific Sellercloud Order ID. |

| SKU | Include only one or more SKUs. |

| Settlement ID | Include orders with specific settlement IDs. A settlement is a channel’s order-related fees, commissions, and taxes. Currently, this filter works for Amazon/FBA, Jet, eBay, Newegg, and Walmart Marketplace settlements. |

| Settlement Status | Include only Amazon and FBA orders in one of two ways:

|

| Show Precise Item Cost | Show the precise item cost up to 4 decimal places. |

| Transaction Type |

|

| Use Original Product ID | Select Yes for the filter to show orders’ shadow SKUs. Select No to show the orders’ parent SKUs. |

| COLUMN | DESCRIPTION |

| Transaction ID | Shows the Sellercloud transaction ID. |

| Transaction Date | Shows the date when the transaction occurred. |

| Transaction Type |

|

| Movement Type | Shows the transaction movement type (Order, PO, etc.). |

| Order Number | Shows the Sellercloud order number. |

| Channel | Shows the order’s sales channel. |

| Channel Order Number | Shows the channel-specific order number. |

| Order Subtype | Shows the order subtype. |

| SKU | Shows the product’s SKU. |

| Quantity | Shows the number of product units sold. |

| Subtotal | Shows the total amount of the items before any discounts, tax, shipping, etc. |

| Shipping | The amount paid for shipping the order. |

| Tax | Shows the amount paid for tax for the order. |

| Grand Total | Shows the total amount of the order, calculated as such: (Subtotal + Shipping Total + Handling + Insurance + Gift Wrap + Tax) – (Discount + Shipping Discount). Note: Only shown if you set the Accounting Basis custom filter to Accrual. |

| Payments | The actual amount the buyer paid (usually the same amount as Grand Total unless there was an underpayment or overpayment). Note: Only shown if you set the Accounting Basis custom filter to Cash. |

| Refunds | Shows the total refund amount from orders. |

| Adjustments | Shows any positive or negative adjustment amounts to orders. |

| Items Cost |

Shows the total amount paid to purchase all items, including refunds and other fees. This amount is based on the item cost on the date of the order, and the calculation method selected in the client setting Order Profit & Loss Calculated Using. This setting lets you calculate by Average Cost, Site Cost, or Last Cost. To get more information, go to Order Item Cost Calculation.

If the cost of an item on order is changed manually, follow these steps to have the updated cost reflected in the order’s profit and loss. |

| Commission | Shows sales rep commission fees. |

| Transaction Fee | Shows the Paypal processing fee. |

| Total Fees | Shows the total sum of the following: shipping cost, commission (channel selling fee), transaction fees (PayPal processing fee), posting fees (eBay listing fee and Reverb bump fee, dropship fees, co-op fees, and tax payable. |

| Other Channel Fees | Shows non-order-related transaction fees, including:

|

| Profit | Cash Profit or Accrual Profit, based on the Accounting Basis custom filter. |

| Profit Margin | Cash Profit Margin or Accrual Profit Margin, based on the Accounting Basis custom filter. |

| ASIN | Shows the product’s Amazon Standard Identification Number (ASIN). |

| Brand | Shows the product’s brand. |

| Channel Order Number 2 | Show a secondary channel order number. |

| Company | Shows the company. |

| Co-Op Fee | Shows an allowance fee from select channels. |

| Discount | Shows the amount of any discounts applied to the order. |

| Dropship Fee | Shows the vendor dropship fee. |

| Gift Wrap Charge | Shows the amount paid for gift wrapping for the order. |

| Handling | Shows the amount paid for handling. |

| Insurance | Shows the amount the buyer paid for order insurance. |

| Manufacturer | Shows the product’s manufacturer. |

| Marketing Source | Shows the name of the marketing source. |

| Non-Order Qty | Shows the number of items affected by non-order transactions. |

| Order Date | Shows the date when the order came in. |

| Order Item Number | Shows Sellercloud’s internal number for each specific item on the order. |

| Original SKU | Shows the original orders’ shadow SKU. Note: Only shown if the Use Original Product ID filter is set to No. |

| Posting Fee | Shows the eBay listing fee and Reverb bump fee. |

| Product Name | Shows the product’s name. |

| Product Type | Shows the product type. |

| Purchaser | Shows the purchaser’s contact email address. |

| Rebate | Shows the incentive amount the vendor reimburses for a product’s promotion. |

| Sales Rep | Shows the sales representative assigned to the order. |

| Settlement ID | Shows the settlement IDs. A settlement is a channel’s order-related fees, commissions, and taxes. Currently, this filter works for Amazon/FBA, Jet, eBay, Newegg, and Walmart Marketplace settlements. |

| Ship Date | Shows the date set for shipping of the order. |

| Ship From Warehouse | Include only orders that were shipped from one or more warehouses. |

| Shipping Cost | Shows the cost of outbound shipping. Includes refunds on shipping costs.

Enabling Predict shipping cost of an order in Client Settings will calculate an Estimated Shipping Cost based on the last 30 days. When the Shipping Cost field is marked with an E, this indicates the Estimated Shipping Cost is being shown. |

| Shipping Discount | Shows any discount applied to the shipping. |

| Unit Cost | Shows the product cost per unit. |

| Vendor | Shows the product’s vendor. |